Taking a Toll on the Perceptions Towards Taxation

I know a bit about taxation and the remarkable effort that goes in to avoiding it.

-Robert Rinder

Talking about taxes is a sure way to get the electorate fired up.

When you think about it, an election is really just a specific point in time when political parties tell you how much they’re going to tax you and what they intend to do with your money once they get it.

You don’t have to have a corner office in a large polling firm somewhere off Bloor Street to know that the electorate would have some pretty pronounced and assertive views towards the topic of taxation.

It’s their money, right?

Opinions and attitudes towards taxation could be measured any number of ways, however, I chose to take into account how people felt about:

Personal income taxes

Corporate income taxes.

The Liberals recently promised that middle class Canadians won’t be taxed on their first $15k. You’ll see from the data below that, for the most part, that promise may pay out dividends.

Let’s get personal:

Source: Canadian Election Study

Surprise, surprise. If you ask them, people will tell you they don’t want to pay more in taxes.

Only a single digit percentage of Canadians over the course of eleven years believed that personal income taxes should be increased. You can see why pledging “your first $15k is tax free” isn’t a half bad campaign promise.

Completely different story when we look at corporate taxes:

Source: Canadian Election Study

Since the CES started asking questions about corporate income taxes, almost half of Canadians believed that they should be increased. We see a bit of a dip during the 2008 election, however, support for increased corporate taxes drifted back to 50% in 2015.

Although I have no data on hand to support it, I have a personal pet-theory that the shift towards increased corporate taxes may be in response to the 2008 recession and an increased level of skepticism and hostility towards corporations more broadly.

Given that only one in ten Canadians overall would support decreased corporate income taxes, it wouldn’t be wise for a campaign to pledge tax incentives to large corporations on the campaign trail.

It’s also interesting to note the delta between those who want corporate income taxes increased and those who want it decreased. Public opinion is, for the most part, far from fond of having the corporate tax rate reduced.

Political takeaway: people vote – corporations can’t.

Source: Canadian Election Study

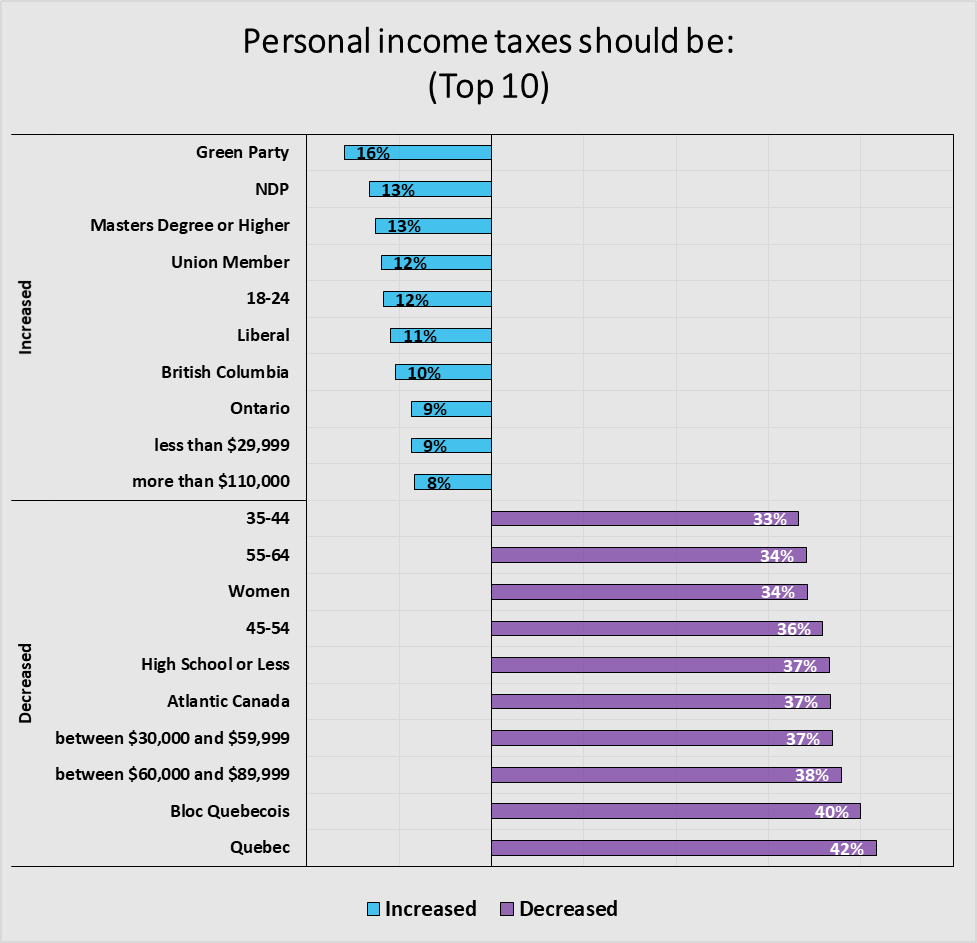

When we look at the top ten demographics that were most in favour of increased/decreased personal income taxes, we see that Green Party supporters were slightly more in favour of increases than the NDP. We also see those with higher levels of education, those who are younger and union members to be in favour of increased personal income taxes.

Quebec and BQ supporters were significantly more likely to believe in decreased personal income taxes. Justin Trudeau’s recent announcement on income tax cuts would bode very well in Quebec – a region of the country that he desperately needs to either hold or make gains in in order to stay in office. He may even win over the support of a few BQ voters while he’s at it.

It should also be noted Justin Tudeau made middle class Canadians the targeted audience for the policy and the above data shows that those in households earning between $30k-$90k are highly favourable of decreased personal income taxes.

Source: Canadian Election Study

When we look at the different demographics overall, we see that increased personal income taxes are unpopular across the board.

As noted earlier, people view corporate income taxes very differently. Support for decreased corporate income taxes is near nil and those who support it aren’t enough to swing fortunes in anyone’s favour.

Source: Canadian Election Study

First thing I thought when I saw the above graph was: wow if the Liberals in 2015 ever wanted to eat the NDP’s lunch (which, it could be argued, they did); corporate income taxes would have made for an effective tactic to do so for a number of reasons:

Someone who identifies as NDP is more likely than not to have the Liberals as their second choice. If an NDP voter saw the Liberals as credible on the issue of taking on corporations then those voters have a greater probability of voting Liberal. This also applies to union members as well.

British Columbia and Quebec are both regions that had a lot of battle-ground ridings that were fought between the Liberals and NDP. Pledging to increase corporate income taxes would have helped motivate motivate these voters to vote Liberal over the NDP.

Generally speaking, those with higher levels of education have a greater probability of identifying with a left-of-centre party and if the Liberals wanted to solidify this segment of the electorate they sure as hell wouldn’t lose those educated voters by advocating for an increased corporate tax rate.

Source: Canadian Election Study

It’s significantly harder to spin the above findings if I were advocating for a lower corporate tax rate. Taking a look at the above, we see that a lower corporate tax rate would not only involve a significant level of political capital to act on due to its unpopularity. Even if you did try and target those voters, they would be marginal to swing the balance of power in your favour and you may alienate the majority of people who want corporate taxes increased. To focus on those voters would be a lot of squeezing for little to no juice.

A Conservative strategist looking at the above data would also be rather confused. On one hand, the Conservatives have a well-established reputation for being the party most likely and willing to cut taxes – both personal and corporate. However, the above shows that for every one Tory that believes corporate taxes should be decreased, more than two believe they should be increased.

Taking into account all of the information above, it may be wise for Conservatives to focus any efforts on reducing taxes to personal income taxes. People vote with their wallets.

Politics is often referred to as a boxing match, so to keep the theme going, the Liberals plan to cut personal income taxes is like a jab. Now they need to go in for the hook with increased corporate income taxes. Pledging to do so would bode well for many left-of-centre-voters and would force the Conservatives into an awkward position where they might have to take a position on the issue.